This Bite of Finance newsletter highlights recent ground-breaking research by Wharton’s finance faculty and papers supported by Finance at Wharton. In this July 2024 issue: intermediary elasticity; the impact of perceived environmental health risk on property values and neighborhood composition; how households are exposed to interest rate risk; factors that determine fund managers’ compensation; and improving anti-money laundering measures.

Do you want Wharton’s most recent finance research delivered to your inbox? Sign up to receive the Bite of Finance newsletter here.

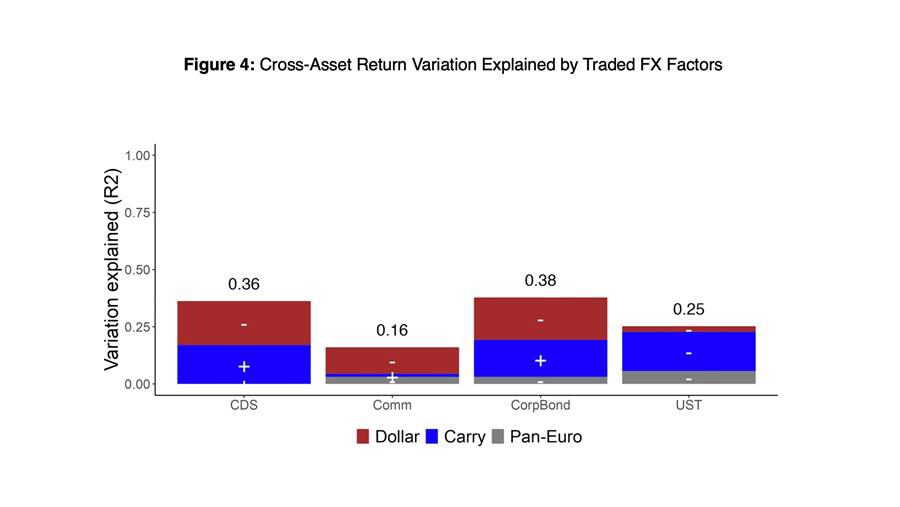

Measuring Intermediaries’ Risk-Bearing Capacity

Paper: Intermediary Elasticity

Authors:

Amy Wang Huber, The Wharton School

Yu An, Johns Hopkins Carey Business School

Supported by the Jacobs Levy Center

More from the author:

“We measure how FX trading affects exchange rates because trading alters the risks that financial intermediaries have to bear, and we find that many other assets are affected by these FX-trading-induced risks.”

– Professor Amy Wang Huber

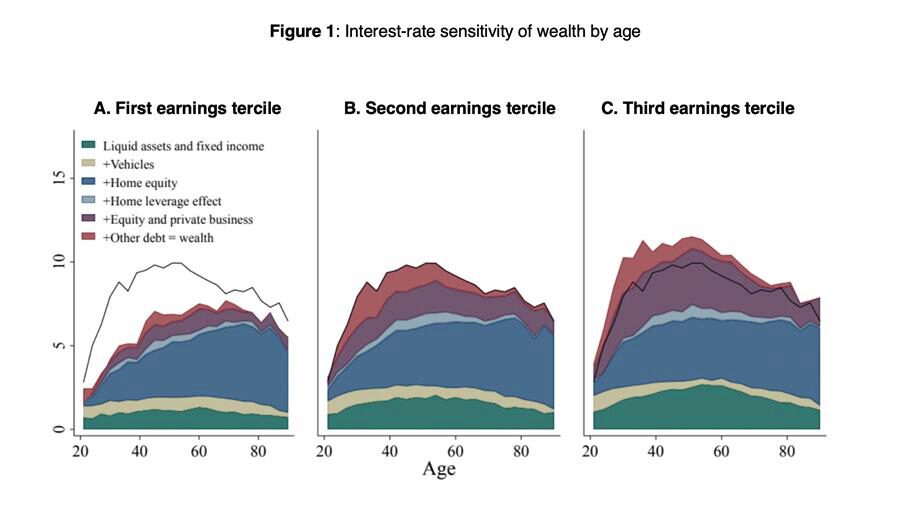

How Households are Exposed to Interest Rate Risk

Paper: Interest-rate risk and household portfolios

Authors:

Sylvain Catherine, The Wharton School

James D. Paron, The Wharton School

Max Miller, Harvard Business School

Natasha Sarin, Yale Law School

Supported by the Jacobs Levy Center

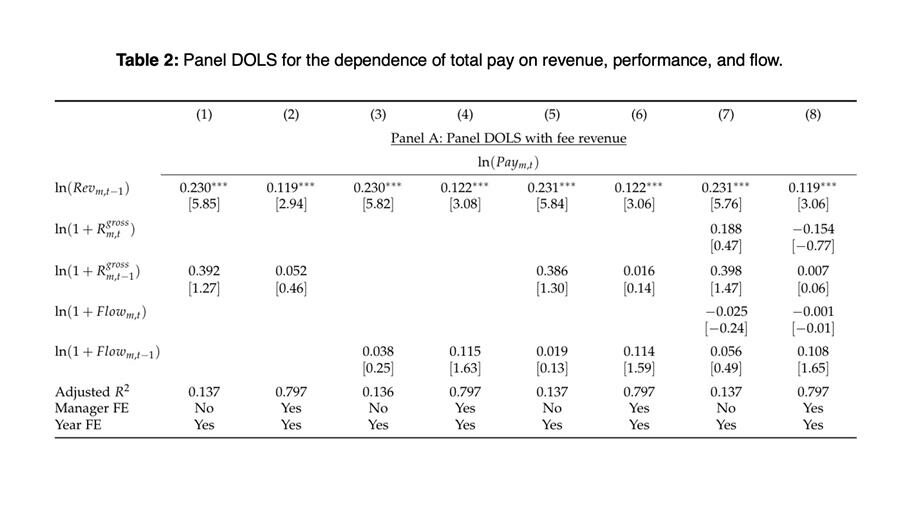

What Determines Fund Managers’ Compensation

Paper: Fund Flows and Income Risk of Fund Managers

Authors:

Winston Wei Dou, The Wharton School; National Bureau of Economic Research (NBER)

Xiao Cen, Mays Business School, Texas A&M University

Leonid Kogan, MIT loan School of Management; National Bureau of Economic Research (NBER)

Wei Wu, Mays Business School, Texas A&M University

Supported by the Jacobs Levy Center

More from the author:

“Managers’ compensation is primarily tied to their funds’ AUM, with strong investment returns increasing pay mainly by boosting AUM and also contributing to bonuses.”

– Professor Winston Wei Dou

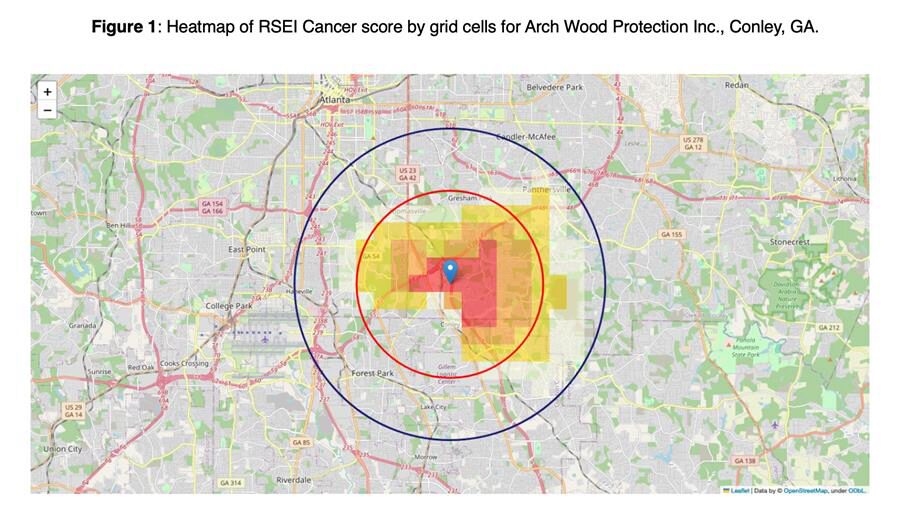

The Impact of Perceived Environmental Health Risk on Property Values and Neighborhood Composition

Paper: Environmental health risks, property values and neighborhood composition

Authors:

Jules H. van Binsbergen, The Wharton School

Joao F. Cocco, London Business School; Centre for Economic Policy Research (CEPR)

Marco Grotteria, London Business School; Centre for Economic Policy Research (CEPR)

S Lakshmi Naaraayanan, London Business School

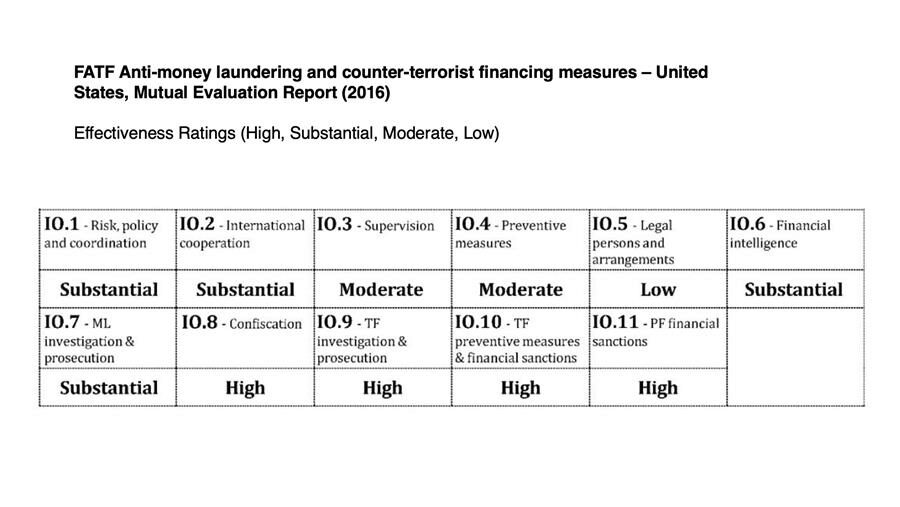

Anti-Money Laundering Improvements

Paper: Anti-Money Laundering: Opportunities for Improvement

Authors:

Kathryn Judge, Columbia University Law School

Anil K Kashyap, University of Chicago Booth School of Business

Supported by the Wharton Initiative on Financial Policy and Regulation (WIFPR)

More from WIFPR:

“In ‘Anti-Money Laundering: Opportunities for Improvement,’ Kathryn Judge and Anil K. Kashyap discuss the history of the U.S. anti-money laundering regime, its effectiveness, and principles for improving it.”

View more posts on the Discoveries blog.

View recent research on the Jacobs Levy Center’s SSRN page or on WIFPR White Papers.